FD vs Mutual Fund – Which is Better for You?

Many people save money in Fixed Deposits (FDs) because they are safe and guaranteed. Others invest in Mutual Funds for higher returns. But which is better for you? Let’s compare.

1. What is a Fixed Deposit (FD)?

- Guaranteed interest (5–7% in India today).

- Very safe, low risk.

- Money locked for a certain period.

2. What is a Mutual Fund?

- Money pooled into stocks/bonds.

- Returns can be higher (10–15%) but also risky.

- Flexible withdrawal (depending on fund type).

| Feature | FD 🏦 | Mutual Fund 📈 |

| Risk | ✅ Safe | ⚠️ Market Risk |

| Returns | 💰 5–7% | 💹 8–15% |

| Lock-in | ⏳ Fixed | 🔓 Flexible |

| Tax Benefit | 📜 Limited | 📜 ELSS (80C) |

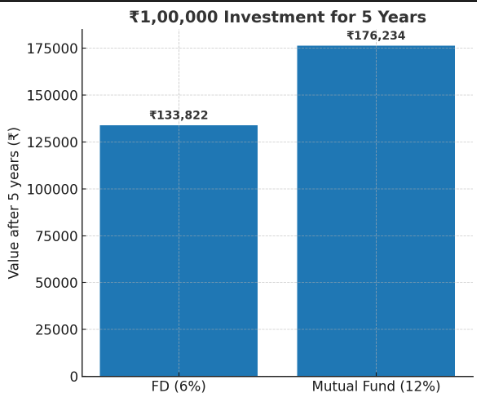

Here’s the pictorial bar chart showing how ₹1,00,000 grows in 5 years:

FD (6%) → ₹1,33,822

Mutual Fund (12%) → ₹1,76,234

Choose FD if you want safety + guaranteed returns.

Choose Mutual Funds if you want higher growth + can take some risk.

Best strategy → Mix both depending on your goals.